Definition

A standby letter of credit, abbreviated as SBLC, refers to a legal document where a bank guarantees the payment of a specific amount of money to a seller if the buyer defaults on the agreement.

An SBLC acts as a safety net for the payment of a shipment of physical goods or completed service to the seller, in the event something unforeseen prevents the buyer from making the scheduled payments to the seller. In such a case, the SBLC ensures the required payments are made to the seller after fulfillment of the required obligations.

A standby letter of credit is used in international or domestic transactions where the seller and the buyer do not know each other, and it attempts to hedge out the risks associated with such a transaction. Some of the risks include bankruptcy and insufficient cash flows on the part of the buyer, which prevents them from making payments to the seller on time. It is seen as a sign of good faith since it shows the buyer’s credit quality and ability to make payment for goods or services even if an unforeseen event occurs.

In case of an adverse event, the bank promises to make the required payment to the seller as long as they meet the requirements of the SBLC. The bank payment to the seller is a form of credit, and the customer (buyer) is responsible for paying the principal plus interest as agreed with the bank.

When setting up an SBLC, the buyer’s bank performs an underwriting duty to verify the credit quality of the buyer. Once the buyer’s bank is satisfied that the buyer is in good credit standing, the bank sends a notification to the seller’s bank, assuring its commitment of payment to the seller if the buyer defaults on the agreement. It provides proof of the buyer’s ability to make payment to the seller.

This type of contract is governed by the rules and uniform uses of the International Chamber of Commerce of Paris, and in particular the Uniform Customs and Practice of International Chambre of Commerce, n. 600, comes into effect on July,1, 2007, subject to compliance with the laws in force in individual countries.

The ICC is a non-state organisation representing the different branches of economic activity, whose main purpose is to facilitate international trade. To this end, and in the context of documentary operations with foreign countries since 1929, it has drawn up rules “Uniform rules and uses relating to documentary credits” (NUU) which, updated over the years (currently in force the NUU. Publication no. 600 Rev. 2007) are the fundamental reference for all international transactions involving settlement by means of the Documentary Credit and Stand-by Letter of Credit instrument as far as they are applicable.

Therefore, in the event of a dispute, international law must be compared with the provisions of the civil code of the country indicated in the contract.

Process

The implementation is similar to the documentary credit except that the standby letter of credit can be sent directly to the supplier without going through his bank.

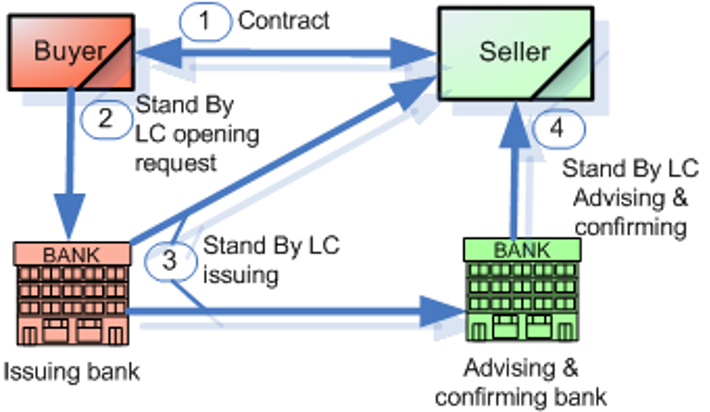

1 Conclusion of contract between the customer / importer and supplier / exporter. During negotiations it was agreed that the payment would be made by an irrevocable letter of credit.

2 Opening Instructions. The client requests his bank to open a Letter of Credit which must be notified without confirmation from the seller’s bank. In opening statements, the client fills out a form specifying the documents required for import the goods. The buyer’s bank verifies the solvency of its clients as well as the signatures on the application form. It also ensures that the instructions are clear and complete.

3 Opening. The customer’s bank issues the Letter of Credit and sent via the SWIFT network to the supplier’s bank. The buyer then receives a copy of the consignment.

After receiving the letter of credit, the supplier’s bank verifies the authenticity of documentary credit and if it is subject to the UCP (Uniform Customs and Practice). It then checks if the instructions not contain errors.

4 Notification. The seller’s bank notifies his client that he received a letter of credit in its favor.

Upon receipt of the notice, the recipient checks whether the conditions specified in the documentary credit are consistent with what had been established during negotiations. If the beneficiary does not agree with any clause, it must ask the buyer to change the terms.

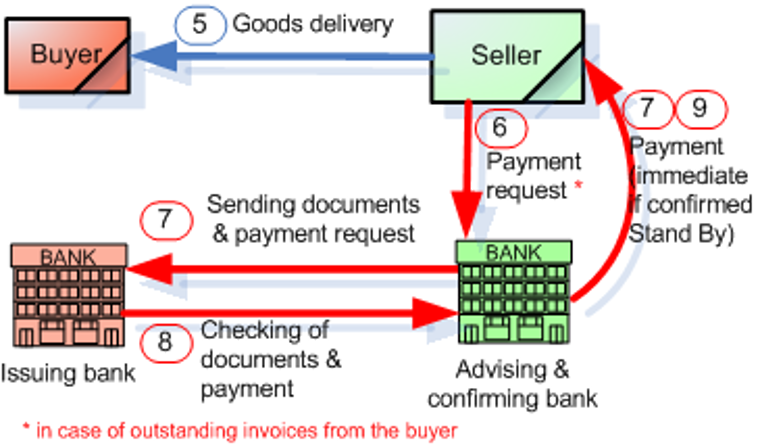

5 The supplier ships the goods to his client. But the buyer does not pay the amount of goods delivered.

6 The provider presents at that time the documents listed in the issue of the standby letter of credit to the correspondent bank (advising or confirming bank) which do the payment after checking the strict compliance of the standby letter of credit.

7 advising or confirming bank presents the documents to the issuing bank against payment that is returned to the supplier. 8-9.

The process of obtaining an SBLC is similar to a loan application process. The process starts when the buyer applies for an SBLC at a commercial bank. The bank will perform its due diligence on the buyer to assess its creditworthiness, based on past credit history and the most recent credit report. If the buyer’s creditworthiness is in question, the bank may require the buyer to provide an asset or the funds on deposit as collateral before approval.

The level of collateral will depend on the risk involved, the strength of the business, and the amount secured by the SBLC. The buyer will also be required to furnish the bank with information about the seller, shipping documents required for payment, the beneficiary’s bank, and the period when the SBLC is valid.

After review of the documentation, the commercial bank will provide an SBLC to the buyer. The bank will charge a service fee of 1% to 10% for each year when the financial instrument remains valid. If the buyer meets its obligations in the contract before the due date, the bank will terminate the SBLC without a further charge to the buyer.

If the buyer fails to meet the terms of the contract due to various reasons, such as bankruptcy, cash flow crunch, dishonesty, etc., the seller is required to present all the required documentation listed in the SBLC to the buyer’s bank within a specified period, and the bank will make the payment due to the seller’s bank.

Swift messages in a SBLC

Swift is a provider of secure message platform for financial institutions mainly for banks. Swift messages are being sent and received by banks in encrypted forms. As a result swift messages are accepted as a valid and reliable way of communication between banks.

An issuing bank sends a swift message to an advising bank in order to inform issuance of a documentary credit. Similarly, the advising bank sends its acknowledgement via a swift message. In particular, MT 700 message is sent by the issuing bank to the advising bank. It is used to indicate the terms and conditions of a documentary credit which has been originated by the Sender (issuing bank).

Swift messages play a key role not only in letters of credit but also other payment methods in international trade such as cash in advance payment, documentary collections, open accounts and bank payment obligations.

Therefore,

- To understand the form of documentary credit: Please look at field 40A : Form of Documentary Credit in the swift message.

- To understand the applicant of the documentary credit. Please look at field 50 : Applicant on the swift message.

- To understand the beneficiary of the documentary credit. Please look at field 59 : Beneficiary – Name & Address on the swift message.

- To understand the applicable rules of the documentary credit. Please look at field 40E : Applicable Rules on the swift message.

- To understand the date of issue of the documentary credit. Please look at field 31C : Date of Issue on the swift message.

- To understand the date and place of expiry of the documentary credit. Please look at field 31D : Date and Place of Expiry on the swift message.

- To understand the currency code and amount of the documentary credit. Please look at field 32B : Currency Code, Amount on the swift message.

- To understand whether letter of credit allows any tolerance level or not. Please look at field 39B : Maximum Credit Amount on the swift message.

- To understand the payment terms of the documentary credit as well as by whose counters letter of credit is payable. Please look at field 41A : Available With…By… on the swift message.

- To understand whether partial shipments and transshipments are allowed or not on the documentary credit. Please look at field 43P : Partial Shipments and field 43T : Transhipment on the swift message.

- To understand the port of loading and port of discharge of the documentary credit. Please look at field 44E : Port of Loading and field 44F : Port of Discharge on the swift message.

- To understand the latest date of shipment of the documentary credit. Please look at field 44C : Latest Date of Shipment on the swift message.

- To understand how goods and services are defined on the documentary credit. Please look at field 45A : Description of Goods &/or Services on the swift message.

- To understand which documents are required under the documentary credit. Please look at field 46A : Documents Required on the swift message.

- To understand what kind of additional conditions are stated on the documentary credit. Please look at field 47A : Additional Conditions on the swift message.

- To understand which party is responsible for the charges of the documentary credit. Please look at field 71B : Charges on the swift message.

- To understand period for presentation of the documents required under the documentary credit. Please look at field 48 : Period for Presentation on the swift message.

- To understand whether the documentary credit is confirmed or not. Please look at field 49 : Confirmation Instructions on the swift message.

- To understand whether any reimbursing bank defined under the documentary credit or not. Please look at field 53A : Reimbursing Bank – BIC on the swift message.

- To understand what sort of instructions given by the issuing bank to the Paying/Accepting/Negotiating Bank under the documentary credit. Please look at field 78 : Instructions to Paying/Accepting/Negotiating Bank on the swift message.

- To understand the second advising bank of the documentary credit. Please look at field 57D : `Advise Through` Bank -Name & Address on the swift message.

Detailed information about the MT 700 and its sub-fields

| Status | Tag | Field Name |

M | 27 | Sequence of Total |

M | 40A | Form of Documentary Credit |

M | 20 | Documentary Credit Number |

O | 23 | Reference to Pre-Advice |

O | 31C | Date of Issue |

M | 40E | Applicable Rules |

M | 31D | Date and Place of Expiry |

O | 51a | Applicant Bank |

M | 50 | Applicant |

M | 59 | Beneficiary |

M | 32B | Currency Code, Amount |

O | 39A | Percentage Credit Amount Tolerance |

O | 39B | Maximum Credit Amount |

O | 39C | Additional Amounts Covered |

M | 41a | Available With … By … |

O | 42C | Drafts at … |

O | 42a | Drawee |

O | 42M | Mixed Payment Details |

O | 42P | Deferred Payment Details |

O | 43P | Partial Shipments |

O | 43T | Transshipment |

O | 44A | Place of Taking in Charge/Dispatch from …/ Place of Receipt |

O | 44E | Port of Loading/Airport of Departure |

O | 44F | Port of Discharge/Airport of Destination |

O | 44B | Place of Final Destination/For Transportation to…/ Place of Delivery |

O | 44C | Latest Date of Shipment |

O | 44D | Shipment Period |

O | 45A | Description of Goods and/or Services |

O | 46A | Documents Required |

O | 47A | Additional Conditions |

O | 71B | Charges |

O | 48 | Period for Presentation |

M | 49 | Confirmation Instructions |

O | 53a | Reimbursing Bank |

O | 78 | Instructions to the Paying/Accepting/Negotiating Bank |

O | 57a | ‘Advise Through’ Bank |

O | 72 | Sender to Receiver Information |

O : Optional M : Mandatory |